Top Guidelines Of San Diego Home Insurance

Top Guidelines Of San Diego Home Insurance

Blog Article

Obtain the Right Protection for Your Home With Tailored Home Insurance Policy Protection

Tailored home insurance policy coverage offers a safety net that can provide tranquility of mind and economic protection in times of dilemma. Navigating the complexities of insurance plans can be difficult, particularly when trying to figure out the precise protection your one-of-a-kind home requires.

Relevance of Tailored Home Insurance

Crafting an individualized home insurance coverage is necessary to make certain that your insurance coverage properly reflects your individual demands and conditions. A customized home insurance coverage exceeds a one-size-fits-all technique, providing you particular defense for your special situation. By functioning closely with your insurance policy provider to customize your plan, you can guarantee that you are sufficiently covered in the event of a case.

Among the essential advantages of customized home insurance is that it permits you to consist of insurance coverage for products that are of specific value to you. Whether you have expensive jewelry, unusual art work, or specialized equipment, a tailored policy can make sure that these ownerships are shielded. Additionally, by customizing your insurance coverage, you can adjust your restrictions and deductibles to line up with your danger resistance and economic abilities.

In addition, a customized home insurance plan thinks about variables such as the area of your building, its age, and any type of one-of-a-kind features it may have. This tailored method aids to mitigate potential spaces in protection that can leave you revealed to threats. Inevitably, investing the time to tailor your home insurance coverage can supply you with peace of mind knowing that you have thorough security that satisfies your specific needs.

Evaluating Your Home Insurance Coverage Demands

When considering your home insurance coverage needs, it is important to review your individual conditions and the specific risks linked with your property. Examine the age and problem of your home, as older homes may need even more maintenance and could be at a greater danger for issues like plumbing leaks or electric fires.

By completely reviewing these elements, you can figure out the degree of coverage you need to sufficiently shield your home and assets. Keep in mind, home insurance is not one-size-fits-all, so customize your plan to fulfill your certain demands.

Customizing Coverage for Your Residential Property

To tailor your home insurance plan successfully, it is necessary to customize the insurance coverage for your specific home and private demands. When tailoring coverage for your home, think about factors such as the age and building of your home, the worth of your belongings, and any kind of distinct functions that might need unique protection. As an example, if you own expensive precious jewelry or artwork, you may require to include extra insurance coverage to shield these products adequately.

Additionally, the area of your building plays a critical duty in tailoring your protection (San Diego Home Insurance). Houses in areas prone to natural calamities like floods or earthquakes might call for extra protection not included in a typical plan. Comprehending the risks connected with your place can assist you tailor your insurance coverage to alleviate prospective damages properly

In addition, consider your way of life and individual choices when personalizing your coverage. If you frequently travel and leave your home unoccupied, you may want to add insurance coverage for theft or vandalism. By customizing your home insurance coverage to suit your certain demands, you can make sure More Info that you have the right defense in position for your property.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

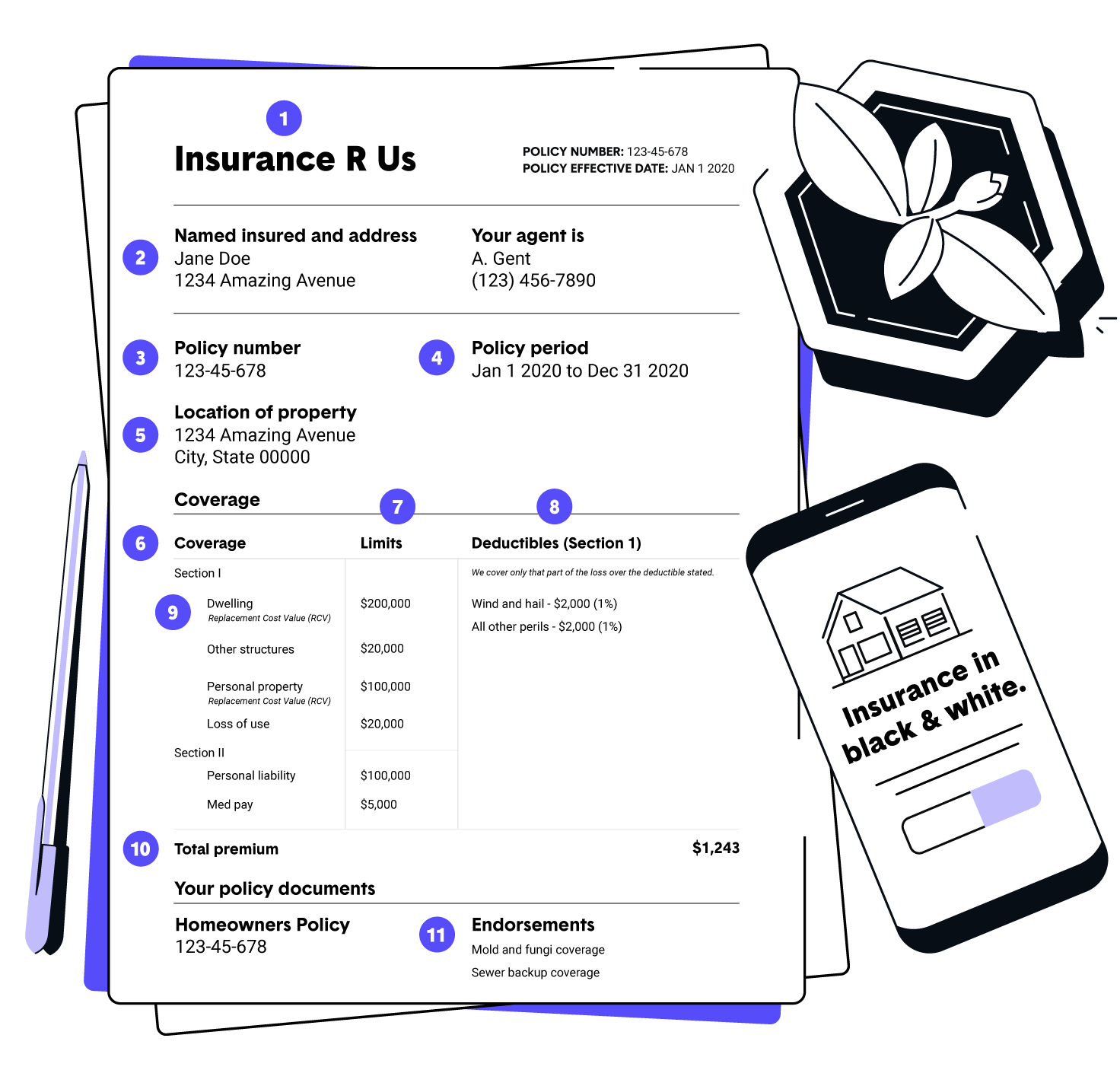

Comprehending Plan Options and Boundaries

Discovering the numerous plan alternatives and limits is vital for gaining a detailed understanding of your home insurance policy protection. Plan alternatives can include protection for the framework of your home, individual valuables, obligation security, extra living costs, and a lot more. By carefully taking a look at plan choices and limitations, you can tailor your home insurance coverage to give the defense you require.

Tips for Picking the Right Insurance Firm

Comprehending look these up the value of selecting the best insurance company is critical when guaranteeing your home insurance protection straightens completely with your needs and offers the needed security for your assets. When selecting an insurance firm for your home insurance coverage policy, consider variables such as the business's track record, monetary security, client service quality, and insurance coverage choices. By following these pointers, you can make a notified decision and choose the appropriate insurance firm for your home insurance coverage requires.

Final Thought

Crafting a tailored home insurance coverage policy is important to make sure that your protection precisely shows your private needs and scenarios (San Diego Home Insurance). Assess the age and condition of your home, as older homes might require more upkeep and can be at a higher risk for concerns like pipes leaks or electric fires

To tailor your home insurance plan efficiently, it is vital to personalize the coverage for your particular home and private needs. When tailoring protection for your residential property, take into consideration elements such as the age and building and construction of your home, the worth i thought about this of your possessions, and any one-of-a-kind functions that may require unique coverage. By carefully checking out plan options and restrictions, you can tailor your home insurance policy protection to give the protection you require.

Report this page